Incentives

City of Novi

Property Tax Abatements

Contact: Victor Cardenas

vcardenas@cityofnovi.org (248)347-0445

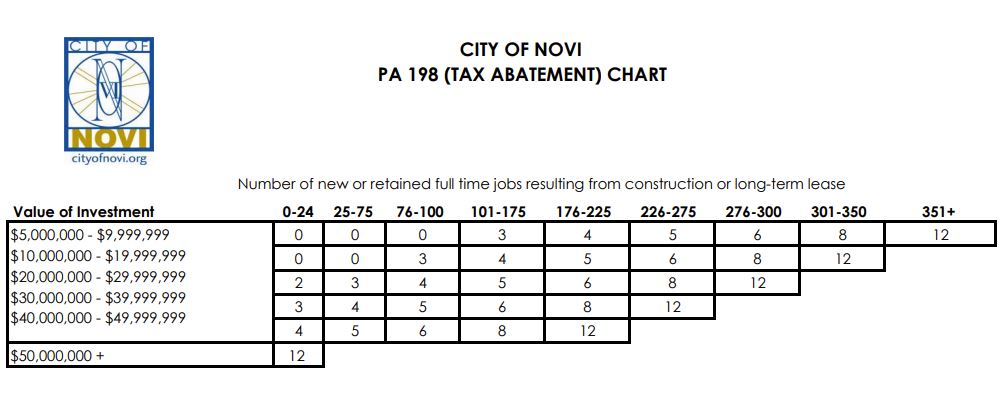

There are several types of property tax abatements available. One such abatement, available pursuant to PA 198 of 1974, is an incentive provided primarily to build new plants in Michigan or renovate and expand assembly and manufacturing, and research plants. The incentive comes in the form of abated property taxes. The value of the project added will produce 50% of the property taxes for a set period of time and then resume to the full tax value at the end of the abatement period.

In order to continue the high quality that is expected by Novi residents and the business community, abatements that do not meet the criteria set forth in the City’s Tax Abatement Policy cannot be recommended unless there are unique or strategic additional reasons. Property taxes and state shared revenue monies are the City’s two primary revenue sources to provide service that help make us attractive. Novi already has one of the lowest city property tax rates (10.2 mills) of comparable communities while providing the exceptional services and prime location that are foremost in business investment design.

PA 198 is just one way that local communities can access state incentives. Historically, the City of Novi has utilized this tool on a few occasions. It is the policy of the City of Novi to consider property tax abatements for large, high quality investors with considerable long range and ancillary benefit. For more information on other state incentives available to qualifying businesses, please contact Victor Cardenas at (248) 347-0445 to set up a joint meeting with an MEDC representative to discuss in detail.

Criteria

Novi has developed a policy for the possible consideration of tax abatements with goals focused on:

Exceptional projects

Rehabilitation

Significant capital investment

High-end salary employment

Architectural excellence

Oakland County’s “Emerging Sectors Strategy” identifies the top ten growth sectors and targets the top companies within each sector, prioritized by companies most likely to consider expanding their business into Oakland County. Those sectors include: Advanced Electronics & Controls, Advanced Materials & Chemicals Alternative Energy & Power Generation, Automotive R & D, Biotechnology, Communications & Information Technology, Homeland Security, Medical Devices & Instrumentation, Micro/Nanotechnology, and Robotics/Automation. Novi shares the County’s vision of attracting and developing these types of high-tech businesses along with the workforce.

Brownfield Redevelopment

Brownfields are typically abandoned or under-used industrial land where expansion or redevelopment is complicated by real or perceived environmental contaminations. Brownfields are a way to utilize funds for encouraging redevelopment. Brownfield projects for the purpose of non-residential, commercial development that create a high quality, non-residential development with immediate use are encouraged and would be reviewed on an individual basis. The City of Novi is open to discussion of establishment of a Brownfield Redevelopment Authority in appropriate circumstances on appropriate, qualifying sites.

Michigan Business Development Program

The Michigan Business Development Program is an incentive program available to eligible businesses that create qualified new jobs and/or make qualified new investment in Michigan. The Michigan Business Development Program is a new incentive program available from the Michigan Strategic Fund (MSF), in cooperation with the Michigan Economic Development Corporation (MEDC). The program is designed to provide grants, loans or other economic assistance to businesses for highly competitive projects in Michigan that create jobs and/or provide investment.

The City of Novi ask that all firms requesting more information about tax abatements for their new or existing business fill out this form.

City of Novi Tax Abatement Policy

Tax Abatement Statement of Purpose

The City of Novi established this policy in order to permit the possible consideration of tax abatement incentives for certain exceptional projects that propose to locate/relocate in the City of Novi. Possible consideration of any tax abatement or any form of local participation with the Michigan Economic Growth Authority will be on a limited basis.

To qualify for the possible consideration of tax abatement under the Plant Rehabilitation and Industrial Development Districts Act, PA 198 of 1974, an applicant must first meet the eligibility requirements. If an application meets such requirements, the application may be reviewed on its own individual merits with respect to the degree to which the project achieves the economic development goals and satisfies the criteria outlined in this policy. Applicants must bear the quantitative burden of proof to demonstrate that exceptional economic benefits will accrue to the City of Novi as a result of a tax abatement approval. Such proposals must specifically relate to the City Council's Tax Abatement Goals and Guidelines. Applicants must substantially satisfy conditions of the policy at initial application in order to be considered for abatement.

Historically, the City of Novi has utilized this tool on a few occasions. It is the policy of the City of Novi to consider property tax abatements for large, high quality investors with considerable long range and ancillary benefit.

In order to continue the high quality that is expected by Novi residents and the business community, abatements that do not meet the criteria set forth in the City’s Tax Abatement Policy cannot be recommended unless there are unique or strategic additional reasons. Property taxes and state shared revenue monies are the City’s two primary revenue sources to provide service that help make us attractive.

Review of applications shall be as required by statute. When the Novi City Council reviews a tax abatement application, it may approve, deny, or approve the proposal with conditions within the time specified by statute.

Following such review, the City Council may consider necessary actions for a tax abatement or participation with other government incentives. All procedures, rights and obligations concerning such exemptions are subject to the Plant Rehabilitation and Industrial Development Districts Act, PA 198 of 1974, as amended.

The maximum number of years abatement may be granted is twelve (12), which is the statutory maximum as of the date of this policy.

Tax Abatement Goals

The City of Novi may establish a Plant Rehabilitation and industrial Development District or participate with any other governmental incentive for any of the following reasons:

A. To attract exceptional projects to the City of Novi in order to provide a greater tax base, without creating a high demand for city services and city-funded infrastructure improvements.

B. To promote the preservation of natural resources that exceeds the requirements of the City of Novi's environmental regulations, and achieves a higher level of preservation of natural environmental features as identified in Novi's 2020 Master Plan for Land Use and Wildlife Habitat Plan.

C. To promote the rehabilitation of obsolete facilities and/or expanding of existing facilities that provides significant benefits to the community, without creating a high demand for city services and city-funded infrastructure improvements.

D. To encourage and promote significant capital investments that will serve as a catalyst for other significant investments within the community.

E. To create or retain a significant number of employment opportunities within the community that offer competitive wages within the industry.

F. To promote architectural excellence that demonstrates state of the art design, placement, sense of place, form, scale and identity that exceed City standards.

Application Criteria

The following criteria will be used to evaluate requests for tax abatement and determination of the number of years of the abatement. The City Council reserves the right to modify the tax abatement criteria to reflect changing objectives, priorities or conditions of the community. All of the following items would need to be initially addressed by the applicant before consideration can move forward.

A. A project must not have started more than 6 months before an application for abatement was received by the City, and be located in a plant rehabilitation district or industrial development district established prior to the commencement of the project.

B. There must be no outstanding taxes owed by the applicant or entity on the project.

C. If the facility is leased, the number of years awarded will not exceed the length of the lease.

D. There is no pending or current litigation, including but not limited to property tax appeals, against the City by the applicant or its agents.

E. Tax incentives will only be offered for the current phase of a project.

F. The project must be fiscally beneficial to Novi from a tax revenue standpoint and must have the potential to increase employment opportunities for citizens of the community.

G. The company must demonstrate it would not locate or expand in the City if tax abatement was not available.

H. The cost disparity between expanding or locating in Novi and alternative locations outside the community must be demonstrated by the applicant.

I. The long term impact of the project on Novi's economy, particularly in both real and personal property.

J. The contributions the business has made to communities where it is currently located (i.e., are they a good neighbor. do they get involved in civic activities).

K. Diversification of the tax base that will have the effect of developing both real and personal property to Novi's tax base.

L. The development will provide enhanced opportunities for the existing business community.

M. Evidence of corporate ongoing profitability, viability and vitality must be demonstrated, such as net profit, by percentage, and in real dollars for the last three corporate fiscal years.

N. Applicants are to provide a fiscal impact analysis that demonstrates the positive impacts to the community and where the benefits outweigh the abated amount in taxes for the duration of the abatement.

O. Any approved tax abatements will undergo a yearly compliance review.

P. The applicant must be committed to the community for the entire term of the tax abatement and into the future. Evidence of this involvement would need to occur once abatement is awarded to applicant.

Q. The granting of the industrial facilities exemption certificate, considered together with the aggregate amount of industrial facilities exemption certificates previously granted and currently in force, shall not have the effect of substantially impeding the operation of the City.